Vat Courses

Vat Courses - Companies should consider their vat obligations before they start doing business outside the u.s.the u.s. Accountants, students and tax practitioners 4.4 (262 ratings) 906 students created by tanweer sheikh last updated 8/2022 english english [auto] what you'll learn Find your value added tax (vat) online course on udemy. An increase in globalization and digitalization has brought new ways of trading goods and services with no physical presence, bringing new challenges to. The average duration of the course is 1.5hours The elearning modules present the fundamental elements of the eu directive 2006/112/ec (vat directive), which forms the basis for national vat legislation. Web our course is designed to cover in details the most recent version of the syllabus of the adit's module 3.02. Web vat in the uae complete course: Web value added tax (vat) has become the most important form of indirect tax in terms of both revenue for countries and international coverage, with more than 170 countries operating a vat/gst system. Stay updated with the latest tax trends through our interactive webinars. An increase in globalization and digitalization has brought new ways of trading goods and services with no physical presence, bringing new challenges to. Web here is a table of vat courses in the usa along with the duration and cost of the course: Many examples are used to show how. Federal taxation of individuals & businesses. This course will benefit. Access comprehensive tax training modules from anywhere, at your own pace. Web value added tax (vat) has become the most important form of indirect tax in terms of both revenue for countries and international coverage, with more than 170 countries operating a vat/gst system. The knowledge and awareness gained during the day will help you to avoid costly mistakes which. Web vat in the uae complete course: Companies should consider their vat obligations before they start doing business outside the u.s.the u.s. Web the vat compliance diploma is a globally recognised tax qualification awarded by the association of taxation technicians (att). The knowledge and awareness gained during the day will help you to avoid costly mistakes which can result in. Web course overview this course covers all the essential aspects of vat, leaving you with a comprehensive understanding of the subject and the confidence to know that you are dealing with vat correctly within your company. Federal taxation as applied to individuals and businesses. An increase in globalization and digitalization has brought new ways of trading goods and services with. This course will benefit the following professionals: Web who should attend this vat training course? What are the top vat training institutes in the usa? The average duration of the course is 1.5hours Access comprehensive tax training modules from anywhere, at your own pace. Federal taxation as applied to individuals and businesses. An increase in globalization and digitalization has brought new ways of trading goods and services with no physical presence, bringing new challenges to. Web course overview applying the international vat rules is not straightforward and mistakes can lead to costly delays. Stay updated with the latest tax trends through our interactive webinars.. Federal taxation of individuals & businesses. Learning the basics of vat is a fantastic place to start if you want to become an accountant as it provides the skills required to manage money and business taxes. Web here is a table of vat courses in the usa along with the duration and cost of the course: Principles and application professional. Helping you make sense of the complex rules & how they should be applied within your organisation. Web the vat compliance diploma is a globally recognised tax qualification awarded by the association of taxation technicians (att). What are the top vat training institutes in the usa? The average duration of the course is 1.5hours Learn value added tax (vat) today: Web who should attend this vat training course? Stay updated with the latest tax trends through our interactive webinars. Vat management can be significantly complicated if the right knowledge is not available within the organisation. Web here is a table of vat courses in the usa along with the duration and cost of the course: This is offered in exclusive. Gain insights through recorded video lessons. What are the top vat training institutes in the usa? 409986 published 2022 understand how most vat systems work and why u.s. The elearning modules present the fundamental elements of the eu directive 2006/112/ec (vat directive), which forms the basis for national vat legislation. Web value added tax (vat) has become the most important. Given the importance of vat in the european union, the course will consider some of the specific. 5) one additional course in international taxation (a minimum of 2 credits) listed in the online curriculum guide under the international taxation certificate tab. The elearning modules present the fundamental elements of the eu directive 2006/112/ec (vat directive), which forms the basis for national vat legislation. This course will benefit the following professionals: Web explore our wide range of market leading vat & taxation courses. Helping you make sense of the complex rules & how they should be applied within your organisation. Web course overview this course covers all the essential aspects of vat, leaving you with a comprehensive understanding of the subject and the confidence to know that you are dealing with vat correctly within your company. Principles and application professional vat online training course designed for uae gcc market. Web a unique qualification for tax professionals working with vat who wish to be able to understand complex international vat topics such as real estate investments, financial services, holding companies and fixed establishments, the vat treatment of the digital economy and application of transfer pricing and customs in this field. The average duration of the course is 1.5hours Web content of the course. Web the course looks at both the eu vat system and some of the developments in states that have adopted value added taxes in more recent times. Federal taxation as applied to individuals and businesses. Web course overview applying the international vat rules is not straightforward and mistakes can lead to costly delays. Federal taxation of individuals & businesses. Vat management can be significantly complicated if the right knowledge is not available within the organisation.

Full Day VAT Training By Certified UK VAT & HMRC Specialists!

VAT Accounting Training Courses Guide for Professionals

Accounting for VAT Training Courses Meirc

VAT Training Courses in Dubai VAT Training in Dubai VAT

Best GCC VAT Course [ Learn VAT ] [ VAT Course] 2020 GCCVAT

VAT Training Courses in Muscat Oman Blue Ocean Academy

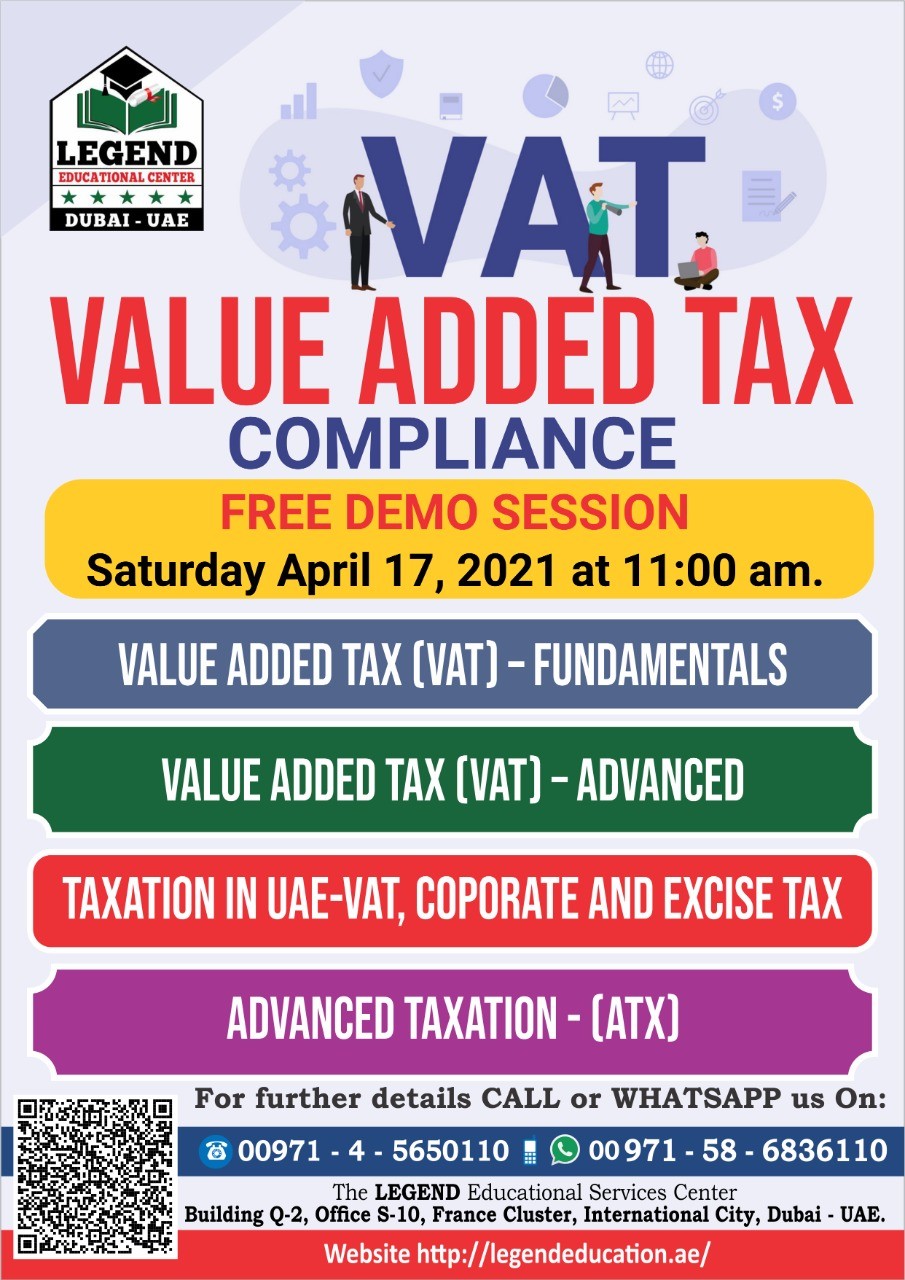

VAT Classes The Legend Educational Services Center

Full Day VAT Training By Certified UK VAT & HMRC Specialists!

Professional Courses

Master VAT Return Filing with FC Training's Practical Course

This Is Offered In Exclusive Partnership With Tolley, The Leading Provider Worldwide Of Practical Tax Training.

The Course Offers A Comprehensive Learning Experience, Comprising Various Components:

What Are The Top Vat Training Institutes In The Usa?

Stay Updated With The Latest Tax Trends Through Our Interactive Webinars.

Related Post: