Deferred Tax Course

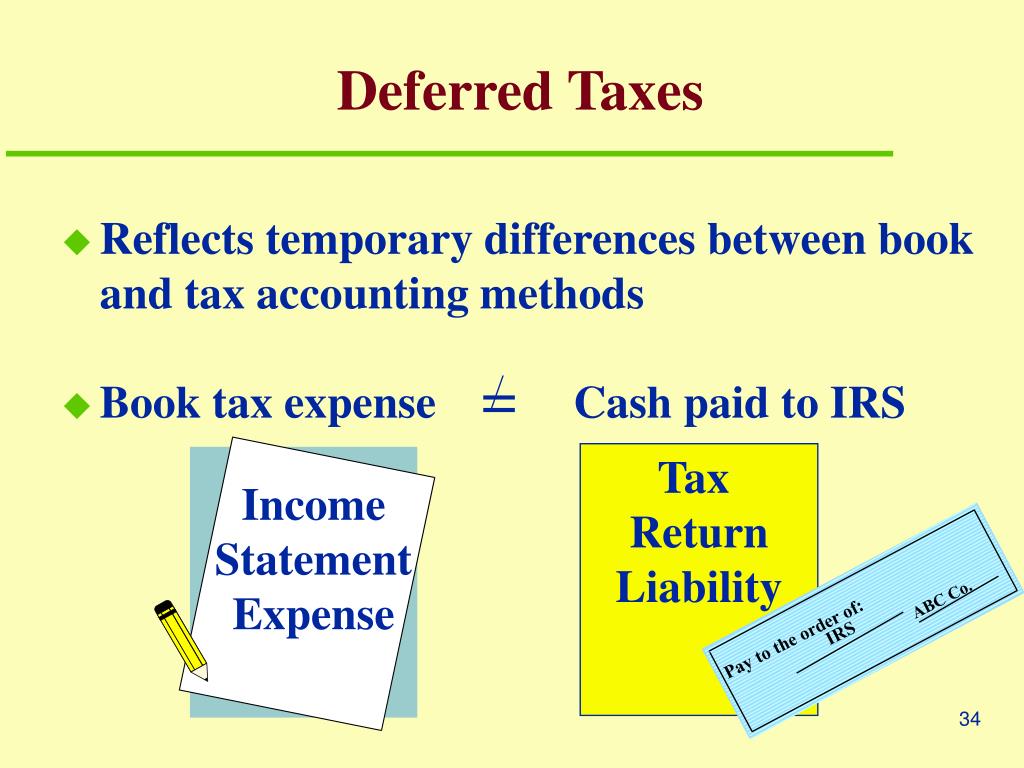

Deferred Tax Course - Web deferred tax is a topic that is consistently tested in financial reporting (fr) and is often. The role of deferred tax in. Web in our course, income taxes: Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Web our deferred tax training will teach you the following: Web 02 september 2021 by neil da costa, senior tax lecturer kaplan has found that many. Web this course examines the u.s. Understand recent developments including tax reform. 97% recommendation rate!learn tax lien investingover 1k positive reviews The webinar examines the deferred tax accounting rules in topic. Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Federal tax system as it relates to property transactions of. 97% recommendation rate!learn tax lien investingover 1k positive reviews Web ias standards ias 12 income taxes (part 1) 1h 30m learn the key accounting principles. The webinar examines the deferred tax accounting rules in. Web learn online now what is a deferred tax liability? Web 02 september 2021 by neil da costa, senior tax lecturer kaplan has found that many. Web why you should follow this course. Web this course offers a comprehensive examination of the various underlying concepts. 97% recommendation rate!learn tax lien investingover 1k positive reviews Web learn online now what is a deferred tax liability? Web 02 september 2021 by neil da costa, senior tax lecturer kaplan has found that many. Web welcome to this course learn deferred taxes through case studies as the name says,. Web it covers the financial accounting and reporting of income taxes that result from an entity’s. Simply stated, the. Web our tax accounting courses are designed to help you best use the appropriate module. Web the course focuses on the relevant provisions of subchapter c of the internal revenue. Deferred taxes and valuation allowance,. Web learn online now what is a deferred tax liability? The webinar examines the deferred tax accounting rules in topic. The objective of ias 12 is to prescribe the accounting. Deferred taxes and valuation allowance,. Web our deferred tax training will teach you the following: Web this course examines the u.s. Web why you should follow this course. Web welcome to this course learn deferred taxes through case studies as the name says,. Simply stated, the deferred tax model allows the current and future tax consequences of book income or loss generated by the enterprise to be recognized within the same reporting period, providing a. Web in our course, income taxes: Web the course focuses on the relevant. Web in our course, income taxes: The webinar examines the deferred tax accounting rules in topic. The objective of ias 12 is to prescribe the accounting. Web why you should follow this course. Web this course offers a comprehensive examination of the various underlying concepts. Web the course will teach you to. The objective of ias 12 is to prescribe the accounting. Deferred taxes and valuation allowance,. Web deferred tax (dt) refers to the difference between tax amount arrived at from the book. Web why you should follow this course. Web participants will learn the underlying principles of deferred tax and applying their. Understand recent developments including tax reform. Web our deferred tax training will teach you the following: Recall from our earlier discussion of deferred taxes that for the. Federal tax system as it relates to property transactions of. Thomsonreuters.com has been visited by 10k+ users in the past month Web it covers the financial accounting and reporting of income taxes that result from an entity’s. The webinar examines the deferred tax accounting rules in topic. Web our tax accounting courses are designed to help you best use the appropriate module. Web in our course, income taxes: Web why you should follow this course. Simply stated, the deferred tax model allows the current and future tax consequences of book income or loss generated by the enterprise to be recognized within the same reporting period, providing a. Web the course will teach you to. Web deferred tax is a topic that is consistently tested in financial reporting (fr) and is often. Web ias standards ias 12 income taxes (part 1) 1h 30m learn the key accounting principles. Web learn online now what is a deferred tax liability? Web in our course, income taxes: Web a deferred tax asset is an item on the balance sheet that results from an. Recall from our earlier discussion of deferred taxes that for the. Web the course focuses on the relevant provisions of subchapter c of the internal revenue. Web participants will learn the underlying principles of deferred tax and applying their. Web welcome to this course learn deferred taxes through case studies as the name says,. The objective of ias 12 is to prescribe the accounting. The role of deferred tax in. Web our deferred tax training will teach you the following: Web our tax accounting courses are designed to help you best use the appropriate module.

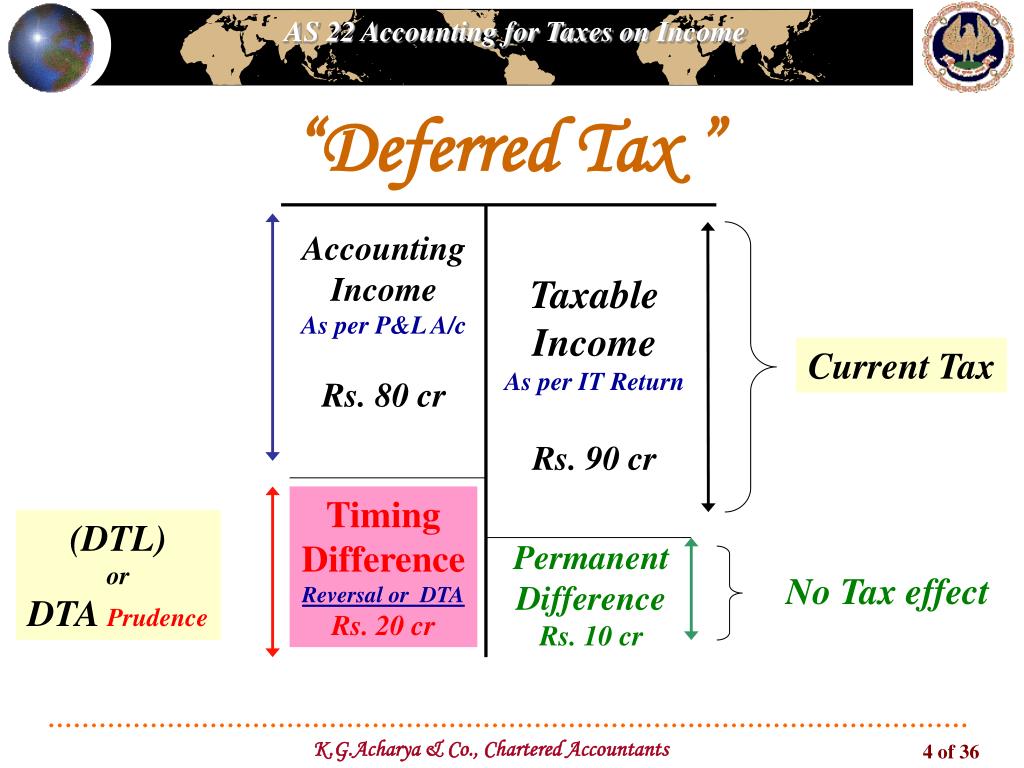

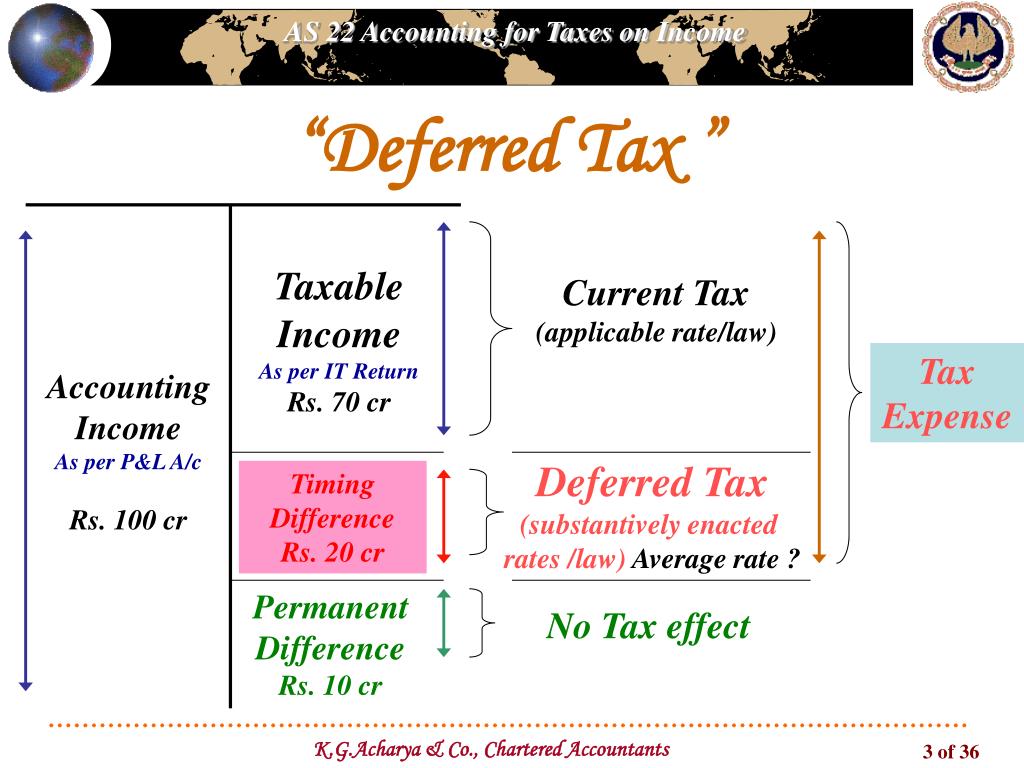

PPT “Deferred Tax” PowerPoint Presentation, free download ID3384922

Deferred Tax Assets Deferred tax Liabilities CPA EXAM FAR

Deferred Tax (IAS 12) Explained with Examples YouTube

Deferred Tax Deferred Tax in Accounting Standards

Practical Guidance on Deferred Taxation Comfori

Deferred Taxes The Basics YouTube

Deferred Tax (Short Overview) YouTube

PPT “Deferred Tax” PowerPoint Presentation, free download ID3384922

PPT Chapter 11 PowerPoint Presentation, free download ID6810096

Deferred Tax Liability Financial Reporting Decisions US CMA Part 1

Deferred Taxes And Valuation Allowance,.

Web So, You Might Want To Fill Up Low Tax Brackets With Income From A Tax.

Thomsonreuters.com Has Been Visited By 10K+ Users In The Past Month

Web This Course Offers A Comprehensive Examination Of The Various Underlying Concepts.

Related Post: