Afsp Online Course

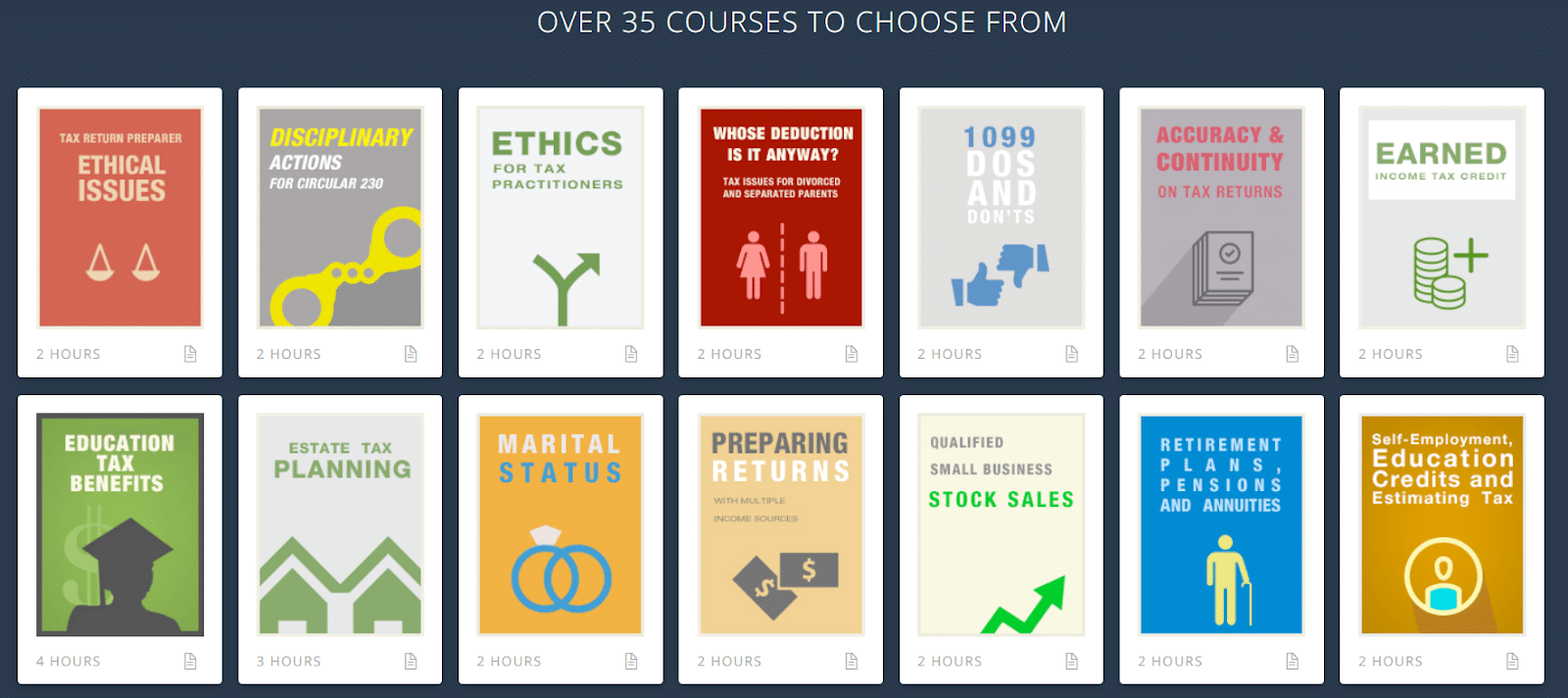

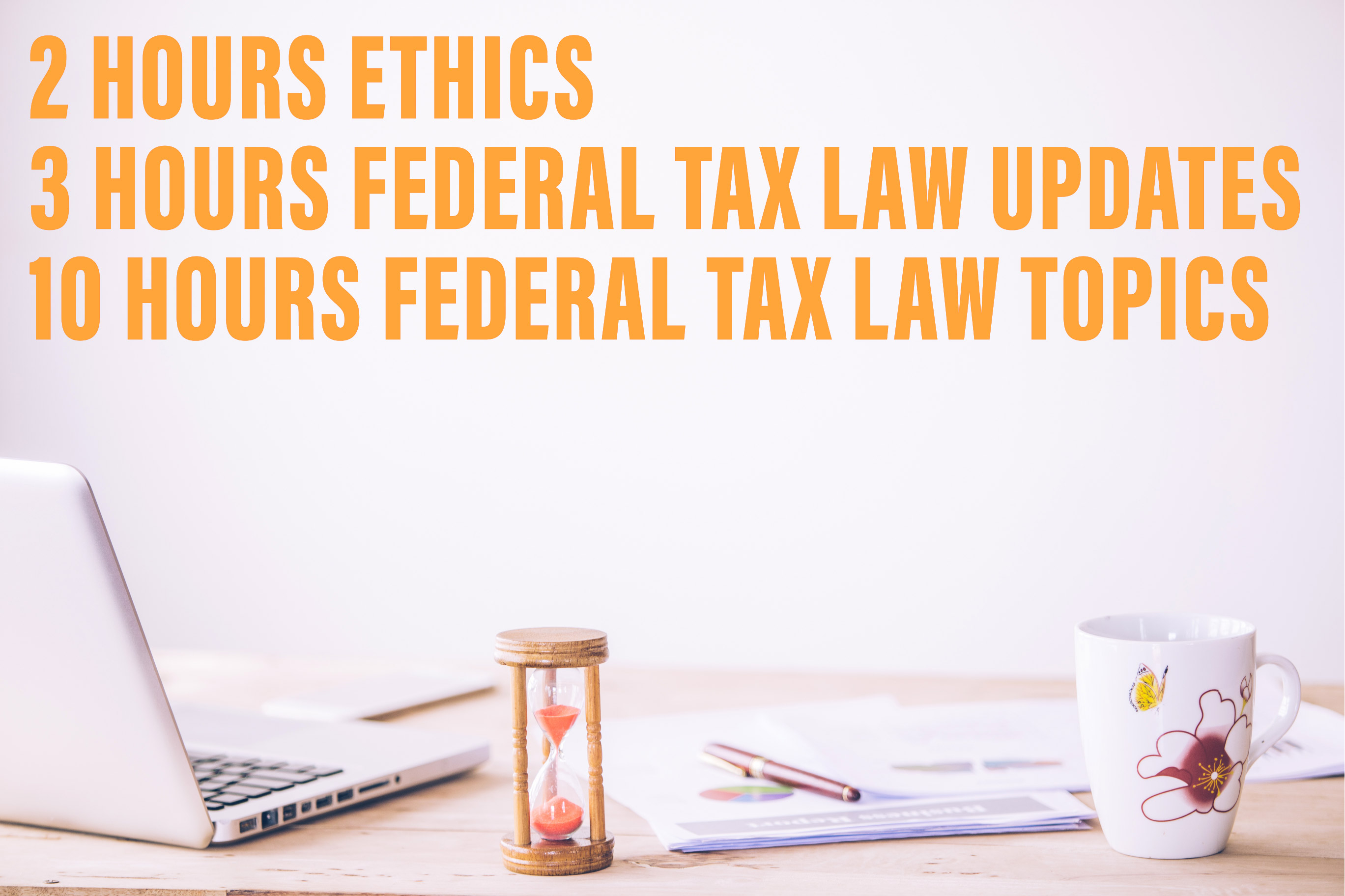

Afsp Online Course - Web earn your afsp record of completion with irs approved continuing education. Web earn your record of completion and become eligible to be listed in the official database for 2024. Claim your free tax course. 10 hours of other federal tax law topics; We'll even report to the irs for you. Of speakers 100+ no of hours 4600+ no of reviews 400k course available 1680+ erc 1031 1040 1099 1099 nec 401 (k) 403 (b) aftr course business tax c corp cannabis cares act charitable trust child tax credit circular 230 erisa estate tax. Although this is a voluntary program, you do not want to dismiss it as unnecessary. It stands for the irs annual filing season program. Fast forward academy afsp course; Is there a limit on the number of years a preparer who passed the rtrp test gets an exemption from the aftr course and test? 10 hours of other federal tax law topics; 2) budgeting and cash flow management. Is there a limit on the number of years a preparer who passed the rtrp test gets an exemption from the aftr course and test? Web we are offering you our most popular critical summary update course called “2023 tax brackets, important thresholds, and inflation adjustments”. Web we are offering you our most popular critical summary update course called “2023 tax brackets, important thresholds, and inflation adjustments” for free. 1) setting financial goals and assessing your situation. The annual filing season program will be available in june. Although this is a voluntary program, you do not want to dismiss it as unnecessary. Please check back here. Web these are the top 5 best afsp courses in 2024: Satisfies the full continuing education requirement for irs annual filing season program. Web earn your record of completion and become eligible to be listed in the official database for 2024. Instant grading, certificates, and pdf course materials. Web the irs annual filing season program (afsp) is very important. Comprehensive tax course is a thorough, a to z guide, providing students with the tools and skills they need to prepare individual tax returns. Web the 2023 annual filing season program (afsp) renewal season begins! Fast forward academy afsp course; 2) budgeting and cash flow management. 4) the time value of money. Comprehensive tax course is a thorough, a to z guide, providing students with the tools and skills they need to prepare individual tax returns. It stands for the irs annual filing season program. Web the afsp record of completion is also a great way to differentiate yourself from other tax preparers in the marketplace. Claim your free tax course. Web. Satisfies the full continuing education requirement for irs annual filing season program. 10 hours of other federal tax law topics; Web earn your afsp record of completion with irs approved continuing education. Web earn your record of completion and become eligible to be listed in the official database for 2024. Web these are the top 5 best afsp courses in. Web earn your afsp record of completion with irs approved continuing education. Financial planning for young adults (fpya), developed in partnership with the cfp board, is designed to provide an introduction to basic financial planning concepts for young adults. (that is a $59 value.) plus, taking this free tax course counts toward your afsp record of completion. Web the afsp. Those who passed the rtrp test will be exempt from the aftr course as long as the program is in place. 4) the time value of money. 8) financial planning as a career. 1) setting financial goals and assessing your situation. The first question that you may have is the easiest one to answer. Wiseguides afsp course #1 lambers afsp courses Financial planning for young adults (fpya), developed in partnership with the cfp board, is designed to provide an introduction to basic financial planning concepts for young adults. 10 hours of other federal tax law topics; Web take this course to participate in continuing education (ce) courses and earn limited representation rights before the. 10 hours of federal tax law. 1) setting financial goals and assessing your situation. Includes 24/7 access to annual filing season program courses and automatic reporting to the irs. Web there are 9 modules in this course. Web take this course to participate in continuing education (ce) courses and earn limited representation rights before the irs. 8) financial planning as a career. Financial planning for young adults (fpya), developed in partnership with the cfp board, is designed to provide an introduction to basic financial planning concepts for young adults. Web the 2023 annual filing season program (afsp) renewal season begins! Wiseguides afsp course #1 lambers afsp courses Is there a limit on the number of years a preparer who passed the rtrp test gets an exemption from the aftr course and test? The annual filing season program will be available in june. Satisfies the full continuing education requirement for irs annual filing season program. (that is a $59 value.) plus, taking this free tax course counts toward your afsp record of completion. Those who choose to participate can meet the requirements by obtaining 18 hours of continuing education, including a six hour federal tax law refresher course with test. Web get access to all afsp ce courses at one single price $199 under subscription subscribe no. Please check back here at that time for purchase options. Instant grading, certificates, and pdf course materials. Of speakers 100+ no of hours 4600+ no of reviews 400k course available 1680+ erc 1031 1040 1099 1099 nec 401 (k) 403 (b) aftr course business tax c corp cannabis cares act charitable trust child tax credit circular 230 erisa estate tax. Claim your free tax course. 4) the time value of money. 1) setting financial goals and assessing your situation.

🥇 Where to Find the Best AFSP Prep Courses in 2024

Afsp Online Course INFOLEARNERS

AFSP

AFSP IRS Approved Continuing Education AFSP

AFSP IRS Approved Continuing Education AFSP

IRS AFSP Certificate Course Groupon

Latino Tax Pro online and live tax and accounting training

AFSP Online Tax Course

![Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]](https://ipassthecpaexam.com/wp-content/uploads/2020/08/ipassthecpaexam.com1_.png)

Ultimate AFSP IRS Guide & Approved AFSP Courses [2021]

AFSP Online Tax Course

Web The Easiest Way To Stand Out As A Tax Preparer.

The Annual Filing Season Program Is A Voluntary Program Designed To Encourage Tax Return Preparers To Participate In Continuing Education (Ce) Courses.

Comprehensive Tax Course Is A Thorough, A To Z Guide, Providing Students With The Tools And Skills They Need To Prepare Individual Tax Returns.

Includes 24/7 Access To Annual Filing Season Program Courses And Automatic Reporting To The Irs.

Related Post: